Recent Posts

Regardless of how big or small your mortgage business is, it is essential to adopt modern technologies to stay afloat in this competitive market. The FinTech industry is evolving to be more customer-driven, and that is why you, as a lender, must provide a swift and friendly experience to your clientele.

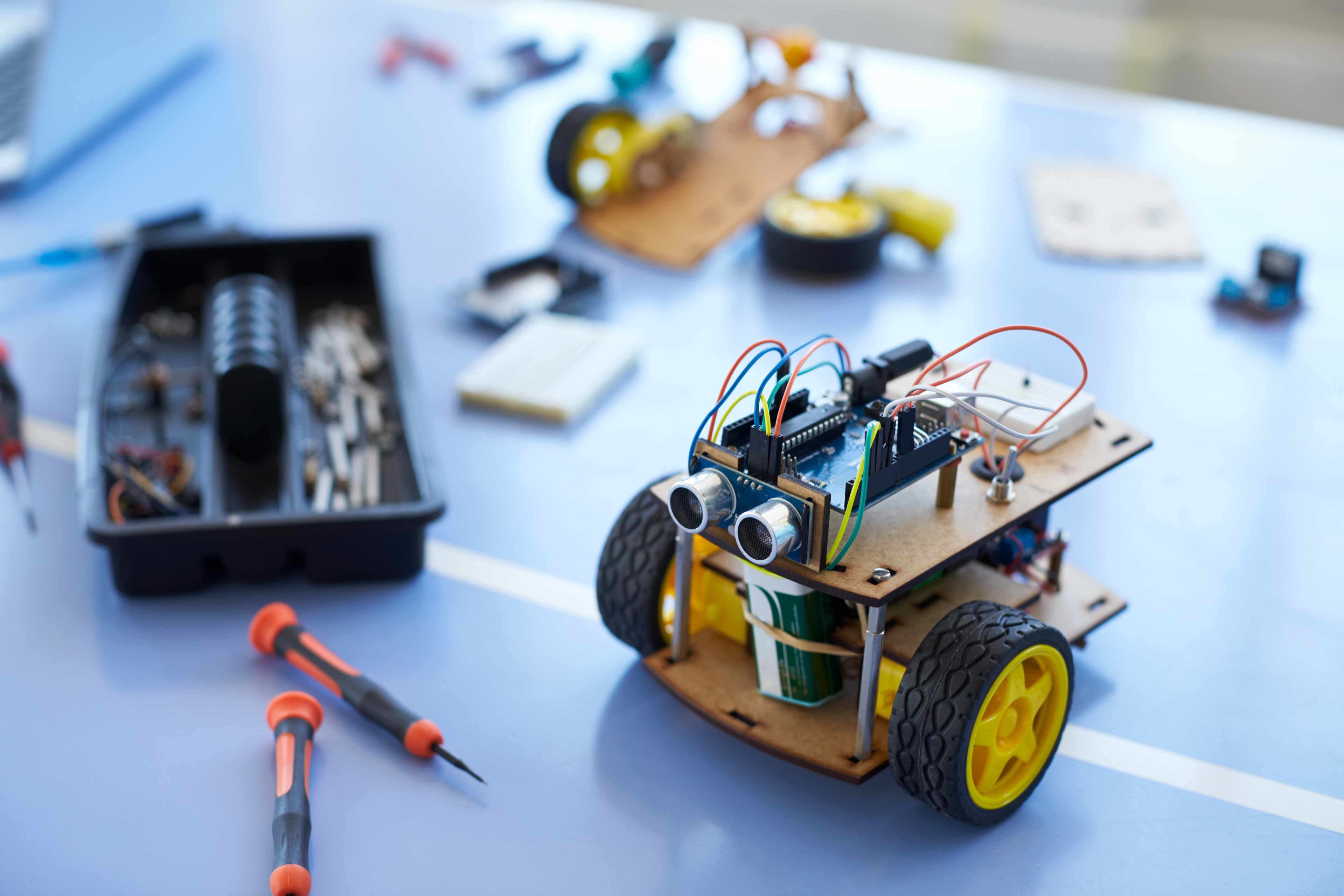

The mortgage industry is undergoing a significant shift in process optimization due to many factors including Covid-19 as well as consumers' demand to bring more efficiency. Since the North American region is severely affected by the pandemic, the workload on mortgage providers has grown to become unreasonably higher than before. Therefore, lenders opt for Robotic Process Automation to replace human-dependent processes in order to speed up the E2E functionality for current and queued clients.