Like every other trendy technology, it can be quite challenging to get your head around blockchain and how it applies in the mortgage space. That’s especially true if you’re not tech-savvy or you’ve conditioned yourself to the conventional centralized system for most of your time.

But now that we’re in a new age, it’s imperative to understand the process in detail. For this, an analogy could do much better.

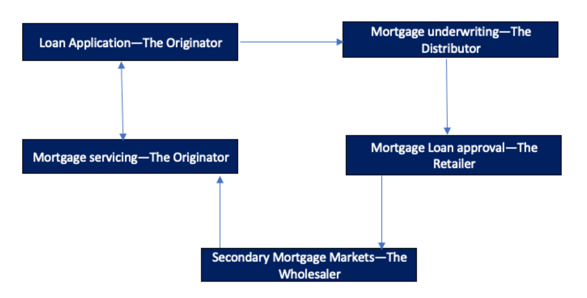

After taking a close look at the role of blockchain in the mortgage life cycle, we noticed a pretty interesting relationship with supply chain management for the food industry.

In a nutshell, blockchain ensures traceability and accountability from the originator to paying off the mortgage—which is a critical downside of centralized finance. So let’s go through each step to understand the relationship.

Loan Application – The Originator

In a blockchain mortgage loan application, the lender predefines all the prerequisite requirements in the code. During application, the borrower remotely interacts with the system through a web-based UI or mobile application. For a successful application, the borrower must submit all the required documents, agree to comply with terms and conditions, and sign up for anything else that the lender feels is necessary.

Ideally, this is what happens in a supply chain. Before the producer releases products, the buyer must prove their interest and commitment by providing the necessary documentation and accepting contract terms. This also alludes to seeds in a food cycle.

Since blockchain smart contracts only work under if-else conditions, the borrower cannot provide partial information. Therefore, the system can accurately keep track of all the transactions right from the originator.

Mortgage Underwriting – The Distributor

The primary goal of mortgage underwriting is to check borrowers’ creditworthiness to lower the lender’s credit risk. Since the threshold conditions are already defined in the smart contract, the system evaluates borrowers’ information and provides feedback instantaneously, saving time.

Note that the distributor acts as the intermediary between the producer and other entities in the supply chain. Underwriters in centralized mortgage lending entities are the link between lenders and consumers because they are key decision-makers.

But in decentralized mortgage lending using blockchain, this role is automated using smart contracts. If the borrower meets the prerequisites, the loan is disbursed and simultaneously recorded on the distributed ledger for accountability.

Mortgage Loan Approval – The Retailer

Once the application process is successful, the borrower receives the approved funds. The documents that the borrower provided during the application serve as collateral for the loan. In case the borrower defaults payment, the lender can use them to claim the property.

This role corresponds to resellers like retailers in the supply chain. They’re always in contact with the consumer, so they offer them credit services—either with or without attached security.

As we have just mentioned, the borrower automatically receives funds once all conditions are met, and the transaction is simultaneously appended on the distributed ledger—this guarantees funder’s accountability.

Secondary Mortgage Markets – The Wholesaler

So far, we have restricted ourselves to primary mortgage markets. But sometimes, local mortgage lenders run out of funds to offer their customers as mortgage—so they need an external financier. This is where secondary mortgage lending comes in handy.

Think of it as a watering stage—where secondary mortgage lenders (wholesalers) quench the thirst of primary mortgage lenders (retailers), thanks to Mortgage-Backed-Securitization (MBS).

However, this is different in decentralized finance. Using blockchain, the secondary mortgage market is consequently automated to reduce paperwork, facilitate faster transactions, and ensure traceability of mortgages.

Mortgage servicing – The Originator

The cycle settles back to the consumer for servicing. The amortization period for mortgages in Canada spans up to 25 years—but it all comes down to the borrower’s initial agreement with the lender. On successful repayment, the borrower recovers their documents, and the contract is terminated.

How this is accomplished in centralized mortgage lending is totally different from blockchain-powered lending systems. The borrower, lender, and even secondary mortgage lenders are interconnected on the distributed ledger to ensure seamless transactions.

For each transaction over the amortization period, the amount is distributed proportionally to the relevant stakeholders—for instance, investors and investment banks in the secondary mortgage market. The beauty of it is that all these numerous transactions are tracked for accountability and are visible to everyone on the network.

Figure 1: Mortgage life cycle analogy with the supply chain management

Adopting FundMore.AI and Blockchain’s Traceability and Accountability in Mortgages

As evident through each stage of the mortgage lending process, blockchain features extremely useful functionalities that are potential game-changers in the mortgage industry. While the technology has not made massive progress so far, one thing you can bet on going forward is its traceability and accountability.

What’s more, this comes at an age where other technologies like Machine Learning, Artificial Intelligence, and Robotic Process Automation are taking digital markets by storm.

Through ML and AI, Fundmore.ai automates the traditionally hectic mortgage underwriting process to help mortgage lenders save time, cost, offer better services to their customers, and ultimately realize more conversions.

Wondering how this can potentially increase your returns? Fill in this form or schedule a demo with our team, and we will be happy to help.