Concerns about climate-related risks have been growing within the financial sector for many years, particularly in the insurance sector. However, at COP26 in Glasgow, the broader financial sector was a key part of the discussions that have reinforced the recommendations of the Task Force on Climate-related Financial Disclosures and the importance of monitoring and reporting associated risks. Integral to these processes is OFSI’s first Annual Risk Outlook where climate change-related risks are prominent.

There are some critical points for Canadian lenders to consider and begin planning for. See our broader analysis of the implications for lenders from OFSI’s announcement, but here we will just focus on the climate aspect of these announcements.

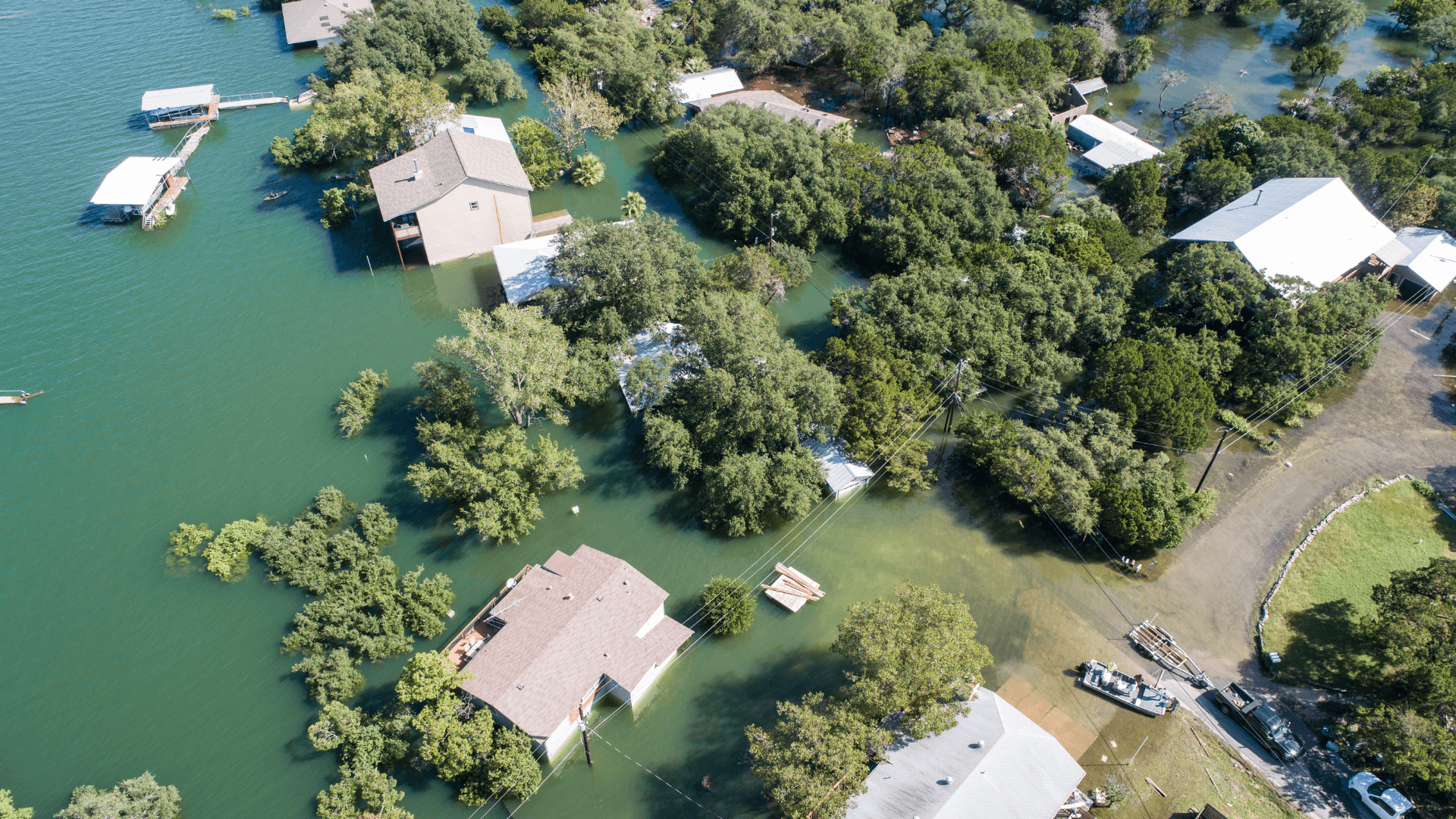

While the potential realities of climate change on the financial sector are highly uncertain, the context of a changing climate in Canada is less so, evidenced by the increased significance of severe weather events that have led to droughts, flooding, heatwaves, devastating storms, and significant wildfire episodes. Canadian lenders need to develop their operational planning now to adhere to the coming regulatory guidelines from bodies like OFSI.

The Insurance Bureau of Canada 2020 Report - Investing in Canada’s Future: The Cost of Climate Adaptation at the Local Level - highlights that insurable costs due to these hazards have more than doubled over the last decade, to $1 Billion per year. Canada’s Changing Climate Report highlights the consequences of our warming climate on Canada, its continued warming trend into the future, and its attribution to human influences on greenhouse gas emissions.

The World Economic Forum’s 2022 Global Risks Report also identifies climate change as a major economic disruptor.

Climate stressors on the financial system risk are long-term and pervasive. Risks are classified as: i) physical risks (direct consequences on assets such as real estate, collateral, or equity value); ii) liability or reputation risks, and iii) transition risks linked to the pace of moving to a low carbon economy.

At COP26, the UN’s watchdog on country commitments (UNEP) noted that current national commitments fall well short of keeping global warming in check below 2 degrees, not to speak of the actions necessary to meet the aspirational goal of remaining below 1.5 degrees as noted in the Paris Agreement.

This suggests a large degree of uncertainty in the financial sector as governments collectively or individually consider more aggressive policies and regulations to meet net-zero obligations before mid-century. This has the potential for more abrupt changes leading to a more disorderly transition to a low carbon economy, which could impact the security and soundness of the financial system more broadly.

OSFI working with the Bank of Canada is taking steps to help the industry build increased resilience into the system through a variety of measures, including regular monitoring and reporting of climate risks, risk scenarios modeling, quantifying financial exposure to climate risks - such as the value of the real estate in Canada’s flood plains, and developing principles-based guidance to support institutions in climate risk management and climate-related financial disclosures. Their commitment to engaging stakeholders within and outside the financial industry, domestically and internationally, offers the opportunity to collaborate and share insights on a range of practices.

Stay tuned.

David Grimes, FundMore Advisor