Canada's banking sector just received a wake-up call, and it came from the regulator.

Gone are the days when lenders rely on emails and accessing consumer information through unsecured systems. The Financial Services Regulatory Authority of Ontario (FSRA) is proposing guidelines to support the lending industry and cybersecurity preparedness. This is big news for the Canadian mortgage industry.

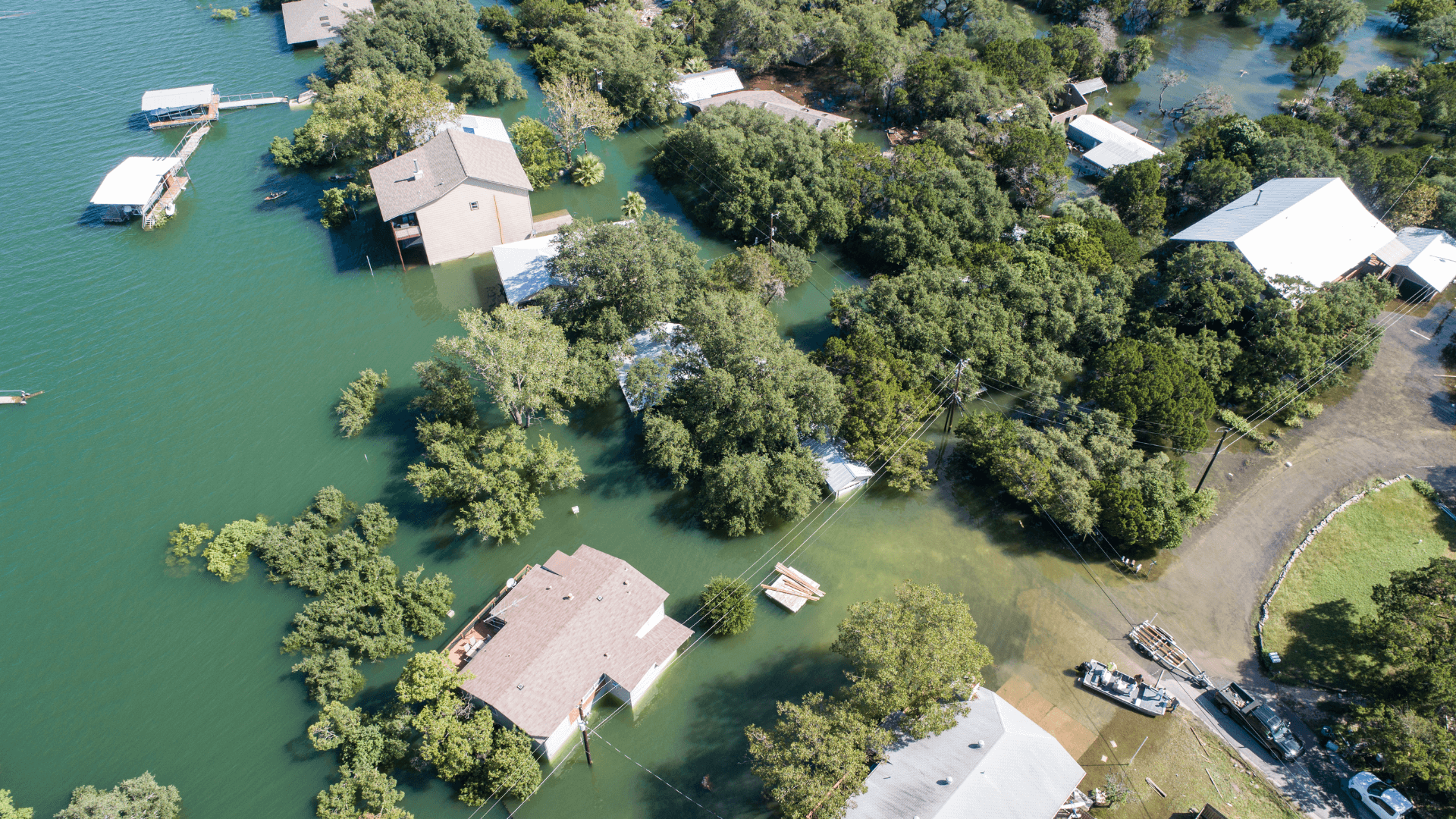

Concerns about climate-related risks have been growing within the financial sector for many years, particularly in the insurance sector. However, at COP26 in Glasgow, the broader financial sector was a key part of the discussions that have reinforced the recommendations of the Task Force on Climate-related Financial Disclosures and the importance of monitoring and reporting associated risks. Integral to these processes is OFSI’s first Annual Risk Outlook where climate change-related risks are prominent.

The Office of the Superintendent of Financial Institutions (OFSI) released its first Annual Risk Outlook report recently, and there are a number of significant implications for Canadian lenders to consider. According to Peter Routledge, OFSI’s Superintendent: