The Office of the Superintendent of Financial Institutions (OFSI) released its first Annual Risk Outlook report recently, and there are a number of significant implications for Canadian lenders to consider. According to Peter Routledge, OFSI’s Superintendent:

“With our inaugural Annual Risk Outlook, we are providing transparency to Canadians about the financial system risks facing our country and our supervisory and regulatory responses to those risks. In so doing, we commit ourselves to strengthening the prudential oversight framework for Canada’s federally regulated financial institutions and pension plans which, in turn, will add to financial system resilience.”

Not only does the report give lenders insight into the current state of risks to our financial industry as a whole, but what the regulator is planning to do about it in the near-term. This report supports OFSI’s Blueprint for OSFI’s Transformation 2022-2025, which will carry with it significant operational implications for lenders in Canada.

Let’s take a closer look at the risks from OFSI’s perspective, and what lenders will be expected to do in the future to mitigate them.

The Risks

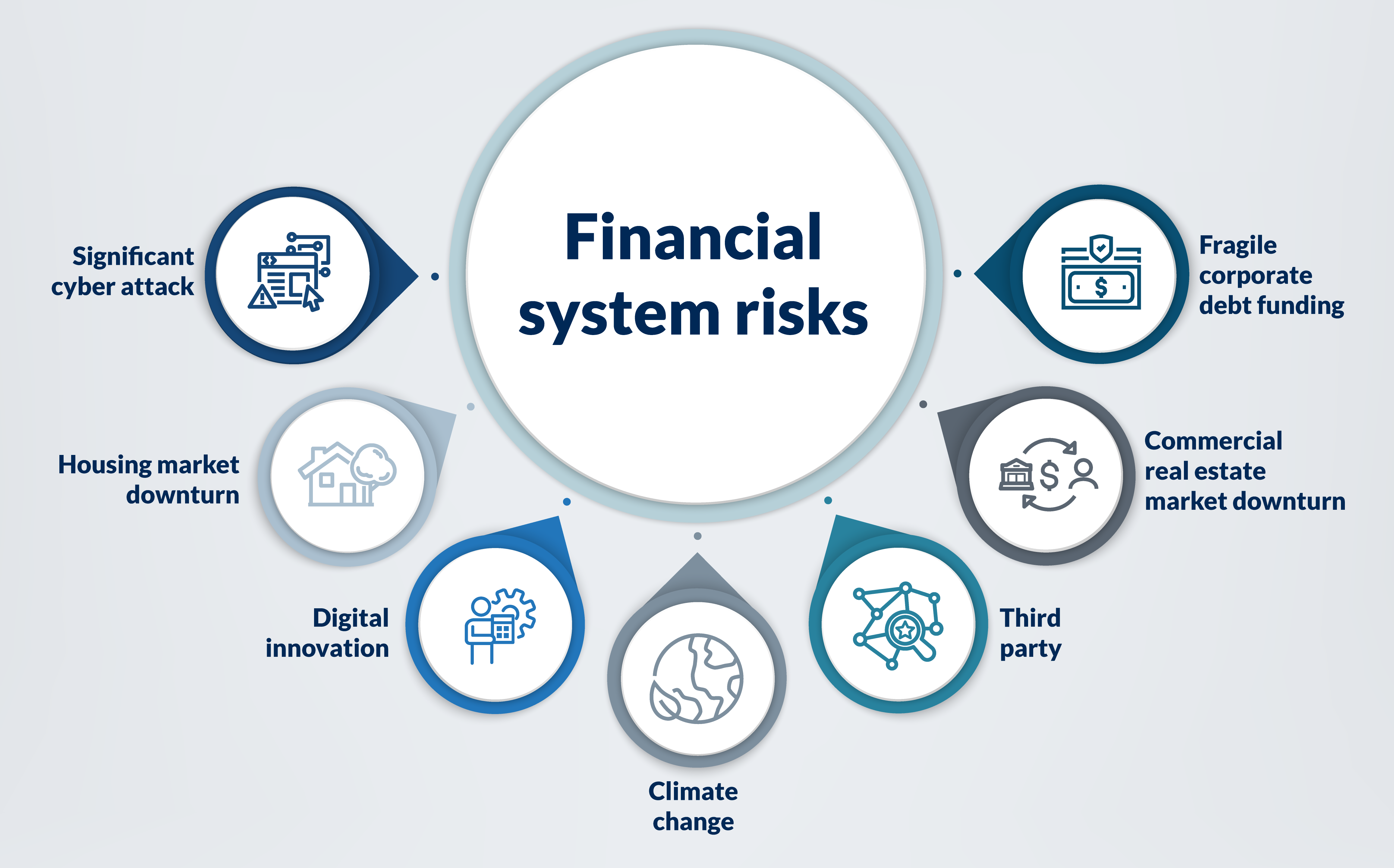

OFSI views the risk landscape for federally regulated lenders in 7 key sections: Significant cyber attack, housing market downturn, digital innovation, climate change, third party risk, commercial real estate market downturn, and fragile corporate debt funding.

Based on these, OFSI will be issuing new directives in the near term to enable lenders to mitigate significant disruptions to the industry and their businesses. Here are some of the bigger takeaways from OFSI’s recent risk report.

1. Cyber Security

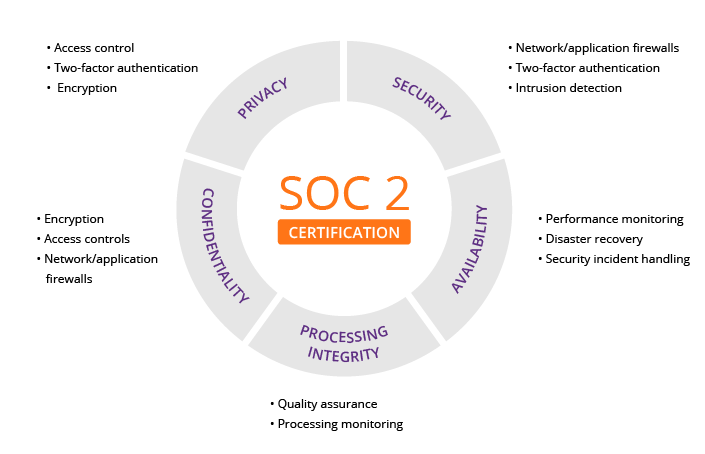

By far the most consequential risk from OFSI’s perspective is cyber security. More than ever lenders in Canada will need to search out technical solutions that are built around proven and certified security practices, such as SOC 2.

Automation and machine learning in mortgage lending dramatically decreases the risks associated with cyber threats, fraud, and human error. OFSI states in their report that they will emphasize “operational resilience while reinforcing operational risk management” in their guidelines on managing cyber security.

Bogdan Blaga, FundMore’s CTO had this to add: “While cloud digitalization brings tremendous process efficiencies it also creates the need for applications to respond to new and more sophisticated cybersecurity threats. Enterprise systems, that formally had to support mostly on-premis use cases, now require to upgrade their security practices and build a new mindset across the entire company.”

Indeed, technical and software solutions will be sought out more and more by lenders who will be mandated to adhere to a new regime of security requirements and guidelines.

2. More Rules for Canadian Lenders

One thing is clear throughout the report, more rules and regulations are coming to the mortgage industry. According to the risk report, cybersecurity guidelines have been drafted that set out OFSI’s expectations for “sound technology and cyber risk management.”

This will require federally regulated financial institutions “to have in place measures that promote resilience to cyber events and technology disruptions.” The final version of these guidelines are expected sometime this year.

Here are some of the other more significant takeaways related to regulations and rules that are in OFSI’s pipeline:

- To risk mitigate a potential housing downturn, OFSI is further expanding their qualifying standards to lending to households in Canada.

- OFSI will issue new guidance on the lending and liquidity requirements related to cryptocurrency.

- Guidance will be issued to outline OFSI’s expectation related to a lender’s climate risk management and climate-related financial disclosures.

3. Third Party Solutions

OFSI presents some interesting concerns around third party solutions businesses, similar to CMLS Solutions team, First National, and MCAP. This new guidance may force some lenders to consolidate, or end up increasing their underwriting and serving teams.

Third-party solutions have greatly benefited the financial services industry from an efficiency, innovation and operational standpoint. As such, financial institutions are increasingly relying on other ecosystems to carry out their critical activities. Risks associated with financial loss and third-party subcontractors’ inability to deliver have therefore increased.

“We have seen several new entrants into the mortgage lending industry over the past few years, many have been able to launch in a brief period without the burden of hiring full underwriting and servicing teams, thanks to third-party services. These new rules may impact how many new lenders may be able to enter the market and force existing lenders into consolidation, noted Chris Grimes, CEO of FundMore on OFSI’s new framework. “However, this does provide an opportunity for next-gen technology providers in the origination and servicing spaces to fill this gap and allow lenders to self-manage these critical internal services by building smaller teams and bringing the services in-house.”

4. Climate Change Risk

Federally regulated financial institutions and private pension plans face many “transversal” risks. Such is a combination of physical and transitional risks that have to do with climate change and the transition to a “low carbon” economy.

According to David Grimes, former President of the World Meterolical Organization and advisor at FundMore: “While the potential realities of climate change on the financial sector are highly uncertain, the context of a changing climate in Canada is less so, evidenced by the increased significance of severe weather events that have led to droughts, flooding, heatwaves, devastating storms, and significant wildfire episodes. Canadian lenders need to develop their operational planning now to adhere to the coming regulatory guidelines from bodies like OFSI.”

Transversal risks directly affect traditional credit, market insurance, operations and legal risks that affect the Canadian financial system and individual financial institutions over time. The delayed transition to a low carbon economy will increase the likelihood of financial stress. Canadian financial institutions, therefore, need to learn not to rely entirely on greenhouse gas-emitting energy sources to withstand the quick reduction of such energy.