It’s no secret that credit score plays a crucial role in a lender's decision to assess a loan. However, does a high score really represent a creditworthy applicant? In this article we’ll explore why a credit score-centric model is the equivalent of judging a book by its cover. Then we’ll look at a few metrics to underwrite loans beyond the credit score.

Credit score: Lenders are using an outdated metric

Did you know that the first version of today’s credit score calculation dates back to the early 1956? The original purpose was to eliminate the prejudice present in credit evaluation and lending.

Since then we’ve seen many improvements to the score’s calculation.

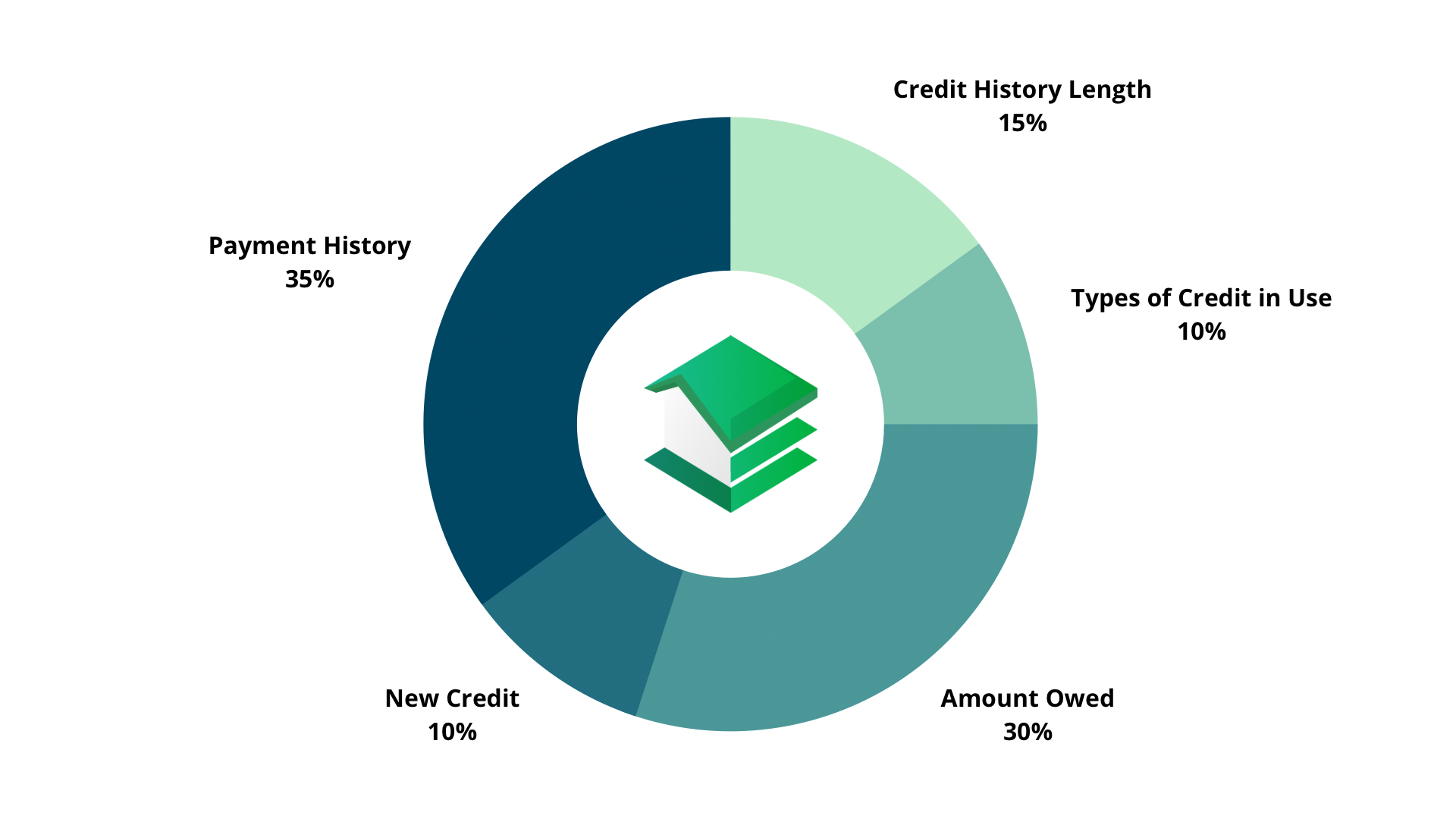

Today the credit score uses 5 main factors to predict the likelihood that an individual will pay their bills.

- 35% of the score is based on payment history and whether the borrower misses obligations.

- 30% is the amount owed and percentage of available credit that is actually used (credit utilization ratios we’ve come accustomed to calculating)

- 15% of the weight goes to length of credit history and how long your credit accounts have been in good standing.

- 10% counts to the credit mix (ie. credit cards, mortgages, student loans etc.)

- 10% is based on inquiries into the applicant’s credit file, and how often new credit applications are filed.

The problem with a 66 year-old model

As we’ve seen above, the credit score appears somewhat robust. Weighed scores. Looking back at an applicant’s history. Payment histories. Then a calculation spits out an easy number.

Couple of problems present themselves.

First, consider that despite updates to the score, it’s still an iteration of the same thing for the last 66 years. What other tool do we use in your modern underwriter tools that’s as old as the credit score?

Second, there are technical issues with how the credit score collects and compiles its data. Equifax recently stated those who borrowed or refinanced in late March or early April-2022 may have received an incorrect credit score. The problem was identified as a coding. Over 700,000 consumers were unable to get the errors on their credit scores fixed. This isn’t surprising if you think of Equifax as crowdsourcing for underwriters. Different participants provide data. However, unlike an established platform like Wikipedia, who performs quality-assurance?

Third, a credit score is the distillation of five metrics made for quick assessments. What if one of the metrics matters less for a particular underwriter? It skews the score and already puts a mark against the applicant. Here’s an example of where this could be an issue: DEI for credit unions who want to help underrepresented communities get access to business or home loans. For low-income earners, credit history might not be present yet accounts for 35% of the score.

Underwriters want more

Relying on the credit score assists with decision making but is it sufficient? In a recent study by VintageScore it was found that “93% of investors are open to considering alternatives to conventional scoring methodologies.” We’ve seen a spike in real estate demand which has directly increased the need for mortgage products. It is thus natural for investors to want a better metric that would take into account things like advances in technology, demographic shifts, data innovation and more.

Quick fixes underwriters can ask for today

The easiest fix to the credit scores underwriters can ask for is that the score be broken into the five categories. Give underwriters the choice to use the existing credit score, or a break-down of all metrics.

This is a quick fix we can ask for as professionals that wouldn’t require much work from the credit bureaus.

Other options to the credit score are already here

Part of the reason the credit score even exists is to limit data overload for the underwriters. Analyzing an entire credit report by hand is extremely time-consuming. Then the underwriter has to look at income, assets, verify the property value and rely on more calculations to get an idea of creditworthiness.

Luckily, the alternative to credit scores is already here: AI-enabled underwriting.

For the non-techies out there, Artificial Intelligence (AI) is fancy way to describe a statistical model that keeps learning the more data you put into it. The main advantage of AI-enabled underwriting is that it learns to make decisions off tens of thousands – if not millions – of credit applications. The speed at which it learns is the equivalent of a career’s worth of underwriting every hour. Now multiply that every day for a month, then a year, and so on.

AI-enabled underwriting vs the old way (ie credit scores)

Going back to the five variables that make up credit scores and example of a DEI-focused credit union.

At face-value, a legacy automated credit-score-heavy algorithm would automatically reject most applicants.

With AI, it’s a whole different way to look at a file. The AI pulls all data points from the credit file, income reports, and declared assets. It then studies each data point and compares it to the hundreds of thousands of other files for delinquencies. So although an applicant may not have a long credit history, the AI might pick up that income to obligation ratios are above-average and that credit utilization is low. Having observed that in such cases delinquencies are low, it would recommend to the underwriter to approve the loan.

Other advantages to AI-enabled underwriting

That was one example of how AI outperforms traditional credit score-centric methods of evaluating loans.

However, AI also presents other advantages for undewriters that credit scores can’t compete with:

Identifying fraud cases: No matter the level of sophistication of a fraudster, there are always mortgage fraud red flags. AI easily identifies statistical outliers and flags risky applications. Credit scores can’t accurately identify fraud by its very nature. It’s a blend of five variables. So inevitably it’ll gloss over potential red flags.

Improve pull-through and reduce costs: It can take upwards of 30 days to close a mortgage. With AI, the bulk of the work takes minutes – which is an immediate time-saver. An underwriter then assesses the work of the AI, ensures compliance, and approves the application. This reduces dropped files and improves pull-through. Credit scores don’t lend themselves as well to automation, and require an underwriter to put the number into context.

Beyond credit scores: enabling underwriters with better tools

Although we’ve painted a negative picture of credit scores, it’s still a tool that worked reasonably well for over 50 years. So all this isn’t to say underwriters and brokerages should ditch it completely. Rather, the industry should look at supplementing its assessment options with more powerful tools. To learn more about how AI can complement traditional underwriting processes, book a demo!